Scheduling a Client Payment on the Remitian Dashboard

This article walks you through scheduling a payment on behalf of a client in Remitian. You’ll select the client, enter payment details, choose the funding account, review, and schedule.

🎥 Training video: See the full walkthrough at the end of this article.

Prerequisites

-

You’re signed in with a role that can create payments (Firm Admin or Accountant).

-

The client record already exists in Remitian.

-

A funding bank account is available for the client (linked via your firm or by the client, optional).

-

You have the payment details ready: amount, tax type/agency, period or reference number (if applicable), and the intended payment date.

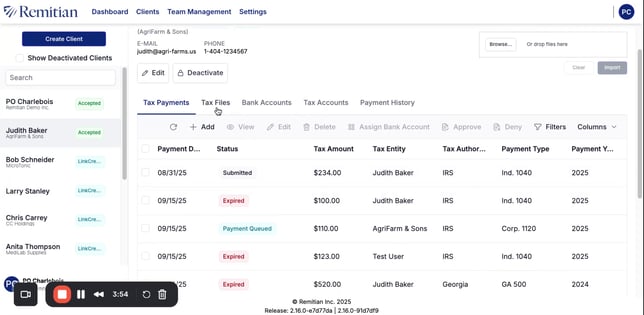

Open Payments

-

In the client navigation, go to Tax Payments.

-

Click Add Payment (or use the Tax Form Import tool).

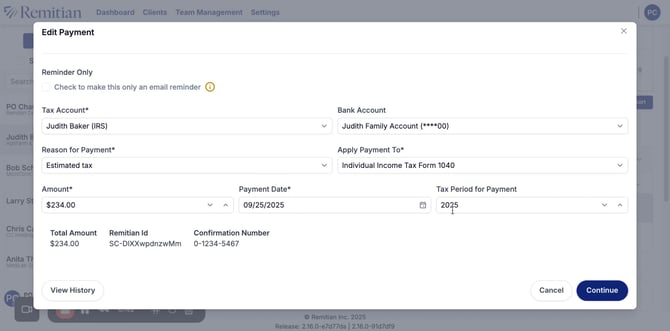

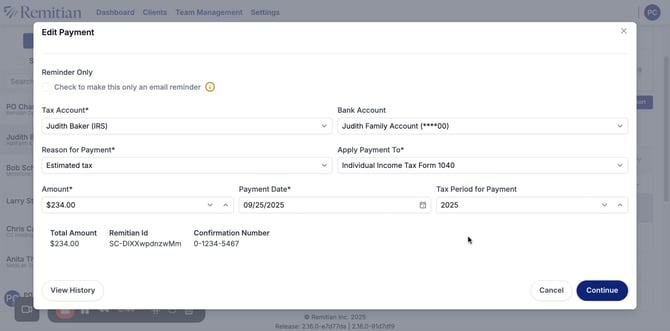

Review/Add Payment Details

-

Choose the Tax Authority / Agency (e.g., the remittance type required for this payment).

-

Enter the Amount to be remitted.

-

Provide any required period, reference, or account identifiers if shown.

Screenshot – Amount & Details

-

Pick the Payment date (or Due date) from the date picker.

Screenshot – Choose Payment Date

Note: If you’re scheduling for a future date, ensure it complies with any agency or cut‑off times used by your firm to ensure timely remittance.

Choose the Funding Account

-

Select the Bank account that will fund the payment.

-

If left empty the client can assign a bank account during the approval process.

Review & Schedule

-

Review the summary: client, tax type, amount, payment date, and funding account.

-

If everything looks correct, click Continue.

Verify the Scheduled Payment

-

After confirmation, you’ll see the payment listed under Tax Payments.

-

Go to Tax Payments → To view Upcoming Payments to view, track, or manage scheduled items (options may include cancel or edit, depending on timing and policy). or view Payment History to view past payments.

Screenshot – Scheduled Payment / Upcoming List

Watch the full walkthrough: